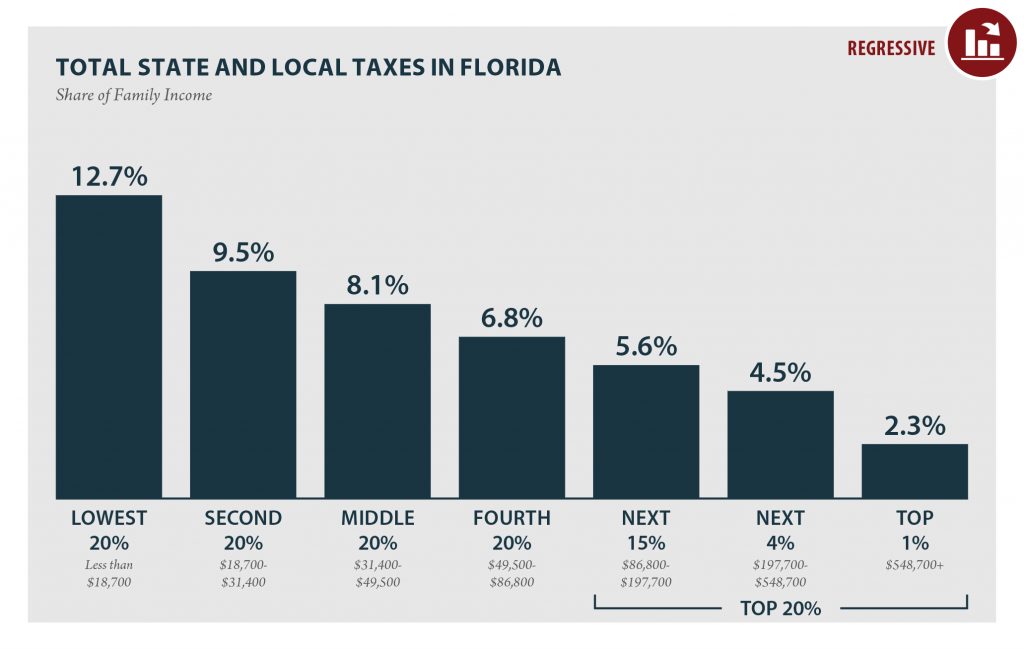

Trump became a legal resident of Florida to avoid paying income taxes. Florida doesn't have income taxes. It's tax system is the kind Trump likes, regressive, taxing a larger percentage of income from people the less they make. And since he is living in D.C. most of the time, he's not even paying as much as a normal resident would in sales taxes.

Florida is the third largest state in the country, and according to a new report, has the third-most unfair state and local tax system in the U.S. That data comes from the Institute on Taxation and Economic Policy (ITEP), a nonpartisan, nonprofit tax policy organization.

Florida is one of nine states in the country without a state income tax, which has given it the image of being a low-tax state. But the authors of the report say that such a tax system exacerbates inequality, and that the state relies too much on sales tax to fund general revenues.

Sales taxes are known as “regressive” because they impose a greater tax burden on the poor. Florida derives more than half of its tax revenue from sales and so-called “excise” taxes (mostly levied on gasoline, alcohol and cigarettes), according to ITEP, which “far exceeds the national average of 35 percent.”

According to the report, only Washington and Texas have more regressive tax systems than Florida. California was ranked as the least regressive tax system in the U.S.

•••••

https://itep.org/whopays/florida/

[Aggravation. The news version of blogger doesn't allow the size and position of linked images to be adjusted so I can show the whole image. From what they have said, the change was a rush job because the platform they had been using was going away, and they didn't know how much time they had to change.]

[If you look at the end of the graph, you will see that families in the top 1% only pay 2.3% of their income in state and local taxes, more than 5.5 times the percentage of families in the lowest 20%.

•••••

No comments:

Post a Comment