https://www.salon.com/2016/04/14/the_1_percent_are_the_real_villains_what_americans_dont_understand_about_income_inequality_partner/

The republican tax plan will make this even worse.

Lynn Stuart Parramore, AlterNet

04.14.2016

•••••

The 99 percent would do well to find common ground with bulk of the 1 percent if we can, because we are going to need each other to tackle this mounting threat from above.

To make it into the 1 percent, you need to have, according to some estimates, at least about $350,000 a year in income, or around $8 million accumulated in wealth. At the lower end of the 1 percent spectrum, the “lower-uppers,” as they have been called, you’ll find people like successful doctors, accountants, engineers, lawyers, vice-presidents of companies, and well-paid media figures.

•••••

Those at the lower end of the 1 percent have very nice houses and take exotic vacations, but they aren’t zipping to and fro in personal helicopters or cruising the high seas in megayachts. In exorbitantly expensive places like New York City and San Francisco, the lower-uppers may not even feel particularly rich. Most of them aren't really growing their share of wealth and plenty are worried about tumbling down the economic ladder. They have reason to worry.

Some lower-uppers are beginning to realize that their natural allies are not those above them on the economic ladder. They are getting the sense that the 0.1 percent is its own hyper-elite club, and lower-uppers are not invited to the party. The 0.1 percent has pulled away because at the tippy top, income has grown much faster than it has for the rest of the affluent.Unlike the lower-uppers, the super-rich folks are armed with every tax dodge in universe: they aren’t expected to pay nearly their share to Uncle Sam. Their income comes largely from capital gains, which are taxed at a far lower rate than income earned from working. As their money piles up higher and higher, their conspicuous consumption knows no bounds—they are building palatial homes and massive art collections and even gold-plated bunkers to protect themselves in case of an uprising. Many don’t really ever put down roots in communities; they roam from New York to London to Dubai to the Cayman Islands, following the favorability of weather and tax codes.

•••••

All told, the 0.1 percent now owns about as much wealth as the bottom 90 percent of America combined. And that’s just the official numbers. Plenty of their wealth is parked overseas and in places where it’s hard to get an accurate count of what they’ve accumulated. To get into the club, which comprises around 115,000 households, you need to start with a nest egg of $20 million—and that’s at the very bottom of the super-rich group. George W. Bush just barely makes the cut. He’s very rich, but not among the highest fliers in today’s second Gilded Age.

•••••

People like Cohen are a big part of the undue concentration of wealth at the expense of workers and communities—they create little of value for society and siphon off funds for our schools and infrastructure with tax loopholes allowed by bought politicians, like the notorious “carried interest” loophole. You also get bankers CEOs like Jamie Dimon of JPMorgan Chase and corporate chieftains paid stratospheric salaries even while driving their companies into the ground, like erstwhile GOP presidential hopeful Carly Fiorina, formerly of Hewlett Packard.

•••••

Unless we act boldly—together—to reduce private concentrations of wealth, inequality will continue to grow and that 0.1 percent will continue to explode because the returns on their wealth exceed increases in salaries and income, as Thomas Piketty noted in his book, Capital in the Twenty-First Century. They can get wealthier and wealthier just by sitting there doing absolutely nothing. In fact, it would be better if they did just sit there and do nothing, because when they do something, it is often reckless speculation that destabilizes the economy. By seriously taxing our wealthiest households, we could raise significant revenues and invest these funds to expand wealth-building opportunities across the economy.

Report Ad

Until we are able to offer a challenge to the 0.1 percent, we will continue to see democracy undermined, social cohesion blown apart, economies destabilized, social mobility stalled, and many other important aspects of our personal and public lives degraded, including our health. We need the lower-uppers to construct a social and political movement big enough and powerful enough to do it.

=========================================================================

https://inequality.org/facts/wealth-inequality/

•••••

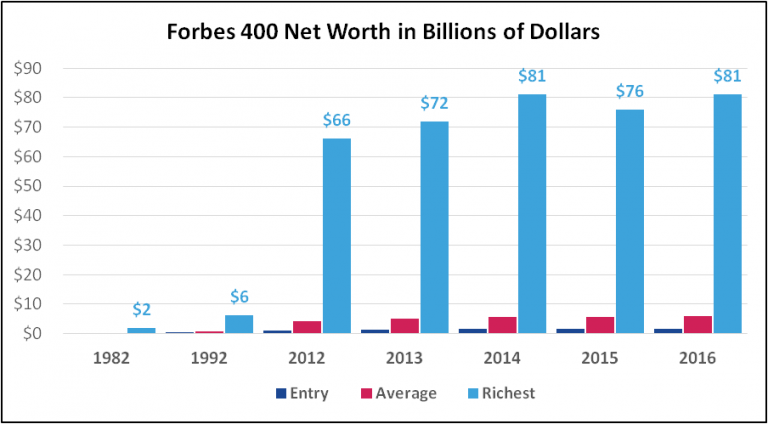

The most visible indicator of wealth inequality in America today may be the Forbes magazine list of the nation’s 400 richest. In 1982, the “poorest” American listed on the first annual Forbes magazine list of America’s richest 400 had a net worth of $80 million. The average member of that first list had a net worth of $230 million. In 2016, rich Americans needed net worth of $1.7 billion to enter the Forbes 400, and the average member held a net $6.0 billion, over 10 times the 1982 average after adjusting for inflation.

Inequality is skyrocketing even within the Forbes 400 list of America’s richest. The net worth of the richest member of the Forbes 400 has soared from $2 billion in 1982 to $81 billion in 2016, far outpacing the gains at either the Forbes 400 entry point or average.

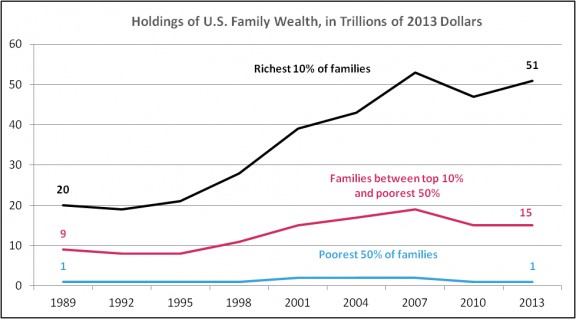

Over the past quarter of a century, only America’s most affluent families have added to their net worth.

•••••

The 21st century has not been kind to average American families. The net worth — assets minus debts — of most U.S. households fell between 2000 and 2011. Only the top two quintiles of the nation’s wealth distribution saw a net increase in median net worth over those years.

The rich don’t just have more wealth than everyone else. The bulk of their wealth comes from different — and more lucrative — asset sources. America’s top 1 percent, for instance, holds nearly half the national wealth invested in stocks and mutual funds. Most of the wealth of Americans in the bottom 90 percent comes from their principal residences, the asset category that took the biggest hit during the Great Recession. These Americans also hold almost three-quarters of America’s debt.

•••••

No comments:

Post a Comment